Welcome to the Future of Finance

Making financial AI, simple

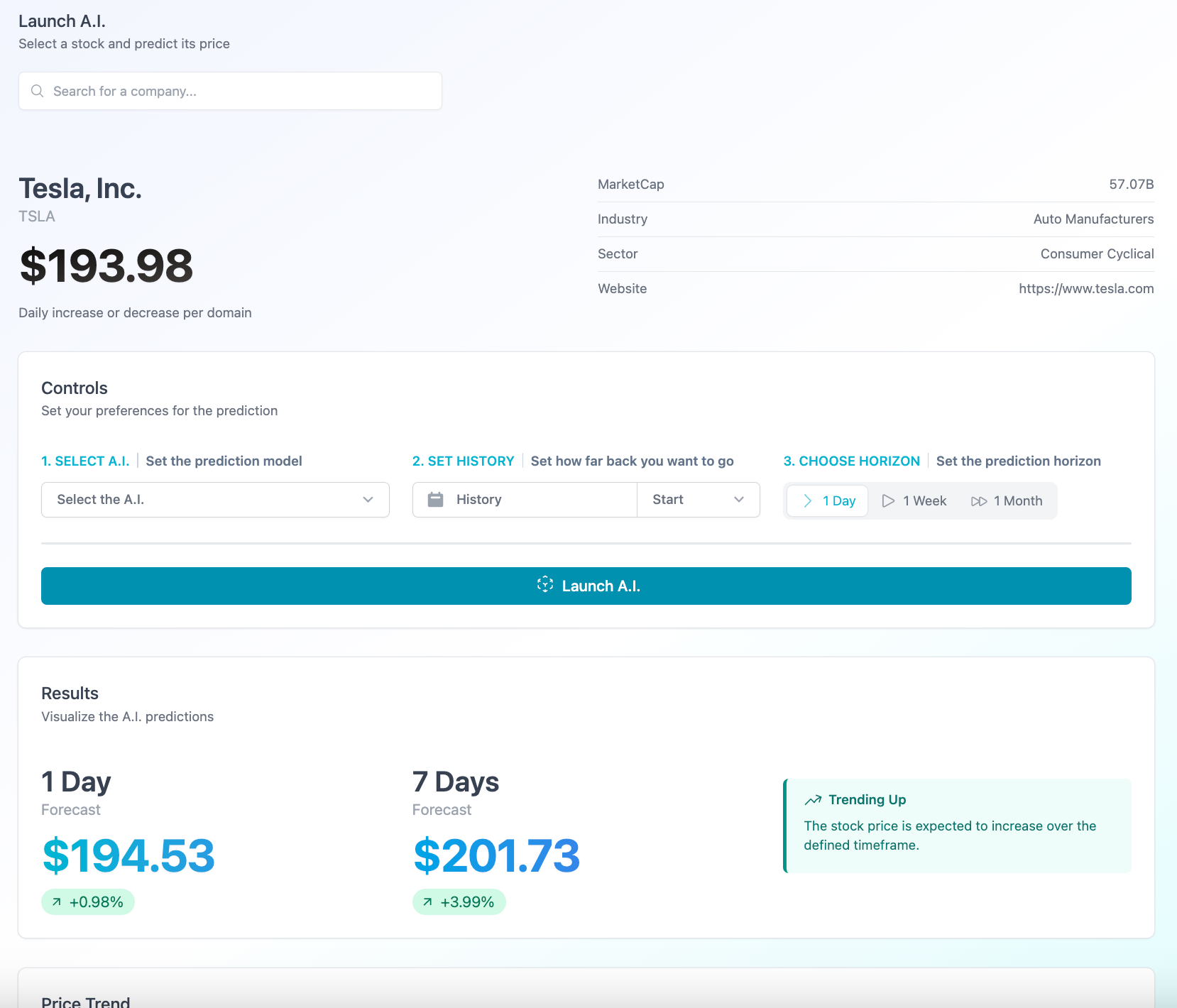

You can now automate the most advanced AI and data workflows for your financial predictions, in just one click. Saving months of work and without needing entire data teams.

Get access to the cutting-edge AI models for financial prediction on a seamless platform. Use the 3 core models for free:

- Random Forest

Random forest is a powerful machine learning algorithm known for its ability to handle noisy and complex data, making it a great choice for stock prediction. It works by constructing a large number of decision trees, each using a random subset of the input data and features. During prediction, each tree in the forest independently makes a prediction, and the final prediction is determined by combining the predictions of all the individual trees, providing insights into important features for stock prediction.

- Gradient Boosting

Gradient boosting works by iteratively building an ensemble of weak decision trees, where each tree is trained to correct the errors made by the previous tree. During each iteration, the algorithm calculates the gradient of the loss function with respect to the current ensemble prediction and fits a new decision tree to the negative gradient. The final prediction is determined by summing the predictions of all the individual trees in the ensemble. Gradient boosting is known for its high predictive accuracy and ability to handle complex interactions between variables.

- Long Short-Term Memory (LSTM)

LSTM, or Long Short-Term Memory, is a type of neural network commonly used for stock prediction. It works by processing time-series data, such as historical stock prices, through a series of memory cells that can selectively retain or discard information. During training, the network learns to adjust the weights of the memory cells based on the input data and the desired output. During prediction, the network takes in new data and generates a prediction based on the patterns it has learned from the training data. LSTM networks are well-suited for modeling complex and non-linear relationships in time-series data.

Transforming financial analysis with AI

Unlock the potential of cutting-edge AI/ML financial predictions. Use our platform, data and APIs to get real-time forecasts and insights from a universe of data.